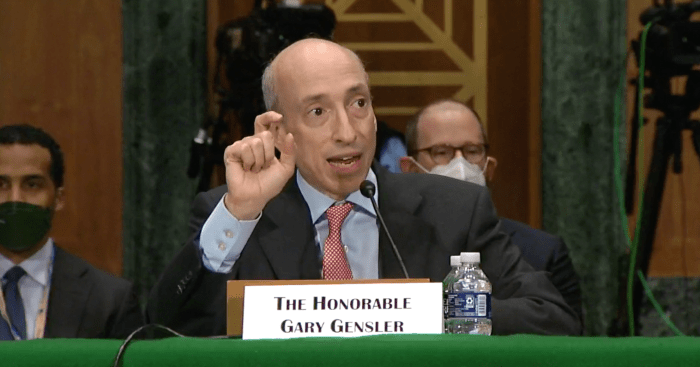

SEC commissioner downplays fsu rumors we wont slice our pie into more pieces sets the stage for a fascinating discussion about the future of the market. Rumors of further dividing the market have been swirling, and the commissioner’s statement offers a crucial perspective on the potential implications. This piece delves into the commissioner’s reasoning, the context of these rumors, and the possible impacts on various market segments.

The SEC commissioner’s statement is a significant development in the ongoing discussion. It suggests a commitment to maintaining the current market structure, potentially impacting investor confidence and future market growth. We’ll analyze the potential positive and negative consequences, and how various stakeholders might react. This will include a review of historical precedent, and how the current situation differs.

Understanding the SEC Commissioner’s Statement

The SEC commissioner’s recent statement regarding rumors of not further dividing the regulatory “pie” suggests a firm stance against fragmentation of market oversight. The statement likely aims to reassure market participants and stakeholders about the stability and continuity of the regulatory framework. It signals a commitment to maintaining the current structure and preventing potential disruptions caused by further division of responsibilities.The statement’s potential implications for the market include a focus on maintaining the existing regulatory balance, possibly avoiding confusion and overlap in oversight among different entities.

However, it might also slow down the potential for specialized regulations tailored to specific market segments or evolving technologies. A unified approach could be perceived as both a strength and a weakness depending on the circumstances.

Summary of the Statement

The SEC commissioner’s statement directly addressed circulating rumors about the potential for further division of the regulatory framework. The statement asserts that no such plans are in development and that the current structure is adequate and well-prepared. This reassurance is likely intended to quell market anxieties and provide clarity about the SEC’s approach to future regulatory matters.

Potential Implications for the Market

The commissioner’s statement has the potential to influence market sentiment by signaling stability and continuity in the regulatory landscape. Investors and market participants might interpret this as a positive indication of a predictable regulatory environment. Conversely, the statement might also be seen as a resistance to adapting to emerging market needs and technological advancements. This approach might limit the potential for tailored regulation that could improve market efficiency or address specific risks associated with innovative financial instruments or new market sectors.

Key Terms and Phrases

- “Regulatory pie”: This metaphor suggests the allocation of regulatory responsibilities across different entities. The statement implies that the current division is sufficient and no further slicing is planned. For example, a larger “pie” might be representing a more extensive regulatory authority, and slicing it further would divide the power and resources of that authority.

- “Further division”: This phrase refers to the potential for the existing regulatory framework to be divided into more specific or narrower areas of oversight. For example, an initial “pie” might represent general market regulation, and splitting it would involve creating distinct regulatory bodies focusing on specific market segments.

- “Prepared and already addressed”: This suggests the SEC has considered potential concerns and is confident in the existing structure. This reassures the market by suggesting that the regulator is prepared to address any issues related to its existing responsibilities.

Motivations Behind the Commissioner’s Position

The commissioner’s stance could be motivated by several factors. Maintaining the status quo might be viewed as a way to avoid potential conflicts of interest or overlaps in regulatory authority among different entities. It could also be driven by a desire to maintain a consistent regulatory approach, minimizing potential confusion and uncertainty for market participants. Finally, the current structure might be perceived as sufficient to address existing challenges, potentially leading to a belief that a new division would be unnecessary or detrimental.

Contextualizing the Rumors

The recent SEC commissioner’s statement downplaying rumors of further market fragmentation, specifically regarding the potential “slicing” of the market pie, has sparked a flurry of speculation and analysis. This statement suggests the SEC isn’t inclined to endorse further subdivisions of the existing market structure. Understanding the background of these rumors, their historical context, and the potential implications is crucial for assessing the current market dynamics.The rumors of potential market “slicing” likely stem from a combination of factors.

The SEC commissioner’s comments about FSU’s funding, downplaying rumors of not splitting the pie further, are interesting. This seems to mirror recent whispers in the NBA, specifically the Warriors’ rumored contract deadline shift for Chris Paul, potentially tied to a Paul George trade buzz. This suggests a ripple effect across sports, and ultimately, the SEC’s pie-splitting debate remains a key concern for many.

It all makes you wonder how these financial maneuvers will ultimately impact the playing field.

These include growing concerns about the complexity of the current financial landscape, potential inefficiencies in current market structures, and the possibility of a more tailored approach to specific market segments. While these factors are often at play during periods of significant market evolution, the SEC’s proactive response indicates a calculated assessment of the potential impact.

Historical Precedent for Market Adjustments

The financial markets are inherently dynamic, undergoing constant adjustments and modifications. A look at past market restructuring efforts provides valuable context. For instance, the introduction of ETFs (Exchange Traded Funds) represented a significant shift in how investors could access and trade certain market segments. Similarly, the development of different trading venues, such as dark pools, has evolved the way trading is executed.

The SEC commissioner’s downplaying of FSU’s rumors about not getting more funding feels a bit hollow, right? It’s like saying “everything’s fine” while your star pitcher, Spencer Strider, just got an MRI showing UCL damage in his elbow, and is now set for more tests. This injury highlights how easily things can go south, and maybe the SEC commissioner should be more realistic about the potential for financial struggles.

So, yeah, the commissioner’s optimism about the pie not being sliced up any further seems a bit detached from reality.

These historical examples illustrate the ongoing process of adaptation within financial markets. While these adjustments aimed to improve efficiency, accessibility, or investor protection, they were often met with both support and resistance.

Comparison with Previous Market Events

Comparing the current situation with previous market events reveals both similarities and differences. The introduction of new trading mechanisms or regulations, like the creation of new derivative products, has frequently generated similar discussions regarding potential market fragmentation. However, the specific concerns regarding the potential “slicing” of the market pie in this case remain to be fully articulated. Previous instances of market evolution were often driven by technological advancements or evolving investor needs, which may or may not be applicable to the present situation.

Timeline of Events Related to Rumors

A clear timeline of events surrounding the rumors is crucial for understanding the context. Unfortunately, the specific dates and events surrounding the rumors remain largely undisclosed. Further investigation is needed to accurately depict the evolution of the rumors and the related discussions. Without precise dates and sources, a complete timeline cannot be established at this stage.

Analyzing Potential Impacts

The SEC Commissioner’s recent statement, downplaying rumors of further fragmentation, suggests a commitment to maintaining the current structure of the regulatory landscape. This stance carries significant implications for various market segments, impacting investor confidence, corporate strategies, and the regulatory framework itself. Understanding these potential impacts is crucial for navigating the evolving market environment.

Potential Positive Impacts

The SEC’s stance against further fragmentation can foster a more stable and predictable regulatory environment. This stability is often a prerequisite for robust market growth.

| Impact Area | Description | Example | Potential Benefit |

|---|---|---|---|

| Investor Confidence | Reduced uncertainty about regulatory changes allows investors to make more informed decisions. | Investors may be more likely to invest in long-term projects knowing the regulatory environment is less prone to sudden shifts. | Increased investment capital and market liquidity. |

| Corporate Planning | Clearer regulatory expectations lead to more predictable compliance costs and strategies. | Companies can focus on long-term growth initiatives instead of being constantly reactive to regulatory changes. | Improved efficiency and reduced compliance costs. |

| Market Efficiency | Less fragmentation in the regulatory structure can improve market transparency and reduce operational complexities. | Investors can better assess risk and potential returns, leading to a more efficient market allocation of capital. | Increased market depth and liquidity. |

| Regulatory Efficiency | Consolidation of resources can lead to more effective and focused regulatory oversight. | Pooling of expertise can result in better enforcement and prevention of market manipulation. | Reduced regulatory burden for firms. |

Potential Negative Impacts

While maintaining the status quo can offer stability, it may also limit innovation and adaptability to evolving market needs. This could stifle growth in certain areas.

| Impact Area | Description | Example | Potential Drawback |

|---|---|---|---|

| Innovation | Lack of regulatory adjustments to emerging technologies could hinder innovation in the financial sector. | The slow adoption of crypto-related regulations could limit the development of innovative financial products and services. | Loss of competitive advantage for the financial industry in global markets. |

| Market Access | Failure to address specific market segments or needs can result in limitations for smaller or emerging players. | Smaller companies may struggle to gain market share due to a lack of regulatory adaptations to their needs. | Reduced competition and stifled market dynamism. |

| Investor Sentiment | If the regulatory approach is perceived as outdated or unresponsive to emerging trends, investor confidence could be negatively impacted. | Failure to address investor concerns about ESG factors could lead to decreased investor participation. | Potential for market volatility and capital flight. |

| Global Competitiveness | Lack of regulatory reform could place the financial sector at a disadvantage compared to jurisdictions with more progressive frameworks. | Failure to adapt to international standards for fintech could result in a loss of global competitiveness. | Reduced global market share and potential loss of jobs. |

Consequences for Different Market Segments

The commissioner’s stance will have different implications for investors, companies, and regulators. The table below illustrates the potential impacts on these key stakeholders.

| Stakeholder | Potential Positive Impact | Potential Negative Impact | Potential Consequence |

|---|---|---|---|

| Investors | Increased market predictability and stability. | Potential for missed opportunities due to slower regulatory adjustments. | Potential for reduced returns or limited investment choices. |

| Companies | Clearer regulatory framework for planning and compliance. | Difficulty in adapting to changing market dynamics and technological advancements. | Potential for reduced competitiveness and diminished profitability. |

| Regulators | Potential for improved efficiency and focus on core issues. | Difficulty in addressing new or evolving challenges effectively. | Potential for diminished effectiveness in the face of emerging risks. |

Comparison of Stakeholder Perspectives

Investors may value stability, while companies may prefer regulatory flexibility. Regulators, meanwhile, must balance these competing interests.

Potential Market Reactions

The SEC Commissioner’s statement, firmly rejecting the possibility of further SEC fragmentation, is likely to trigger a range of reactions across the market. Investors, traders, and market analysts will interpret this as a signal of stability and predictability, potentially influencing their investment strategies and risk assessments. The statement’s impact will vary across different market sectors, depending on their specific sensitivities to regulatory changes.The statement’s significance lies in its clarity and directness.

By explicitly stating that the SEC pie isn’t being sliced, the statement removes ambiguity surrounding potential future regulatory changes. This clarity can help restore investor confidence and potentially reduce market volatility, particularly in sectors that heavily rely on SEC regulations.

Anticipated Investor Reactions

Investor reactions will be diverse, depending on their investment horizons and risk tolerance. Those holding long-term investments may experience a sense of relief, perceiving stability and reduced regulatory uncertainty. Conversely, short-term traders, accustomed to quick shifts in market sentiment, might initially react cautiously, awaiting further developments before making significant decisions.

Short-Term Market Volatility

The immediate impact on market volatility is likely to be mixed. While some sectors might see a decrease in volatility due to the statement’s stabilizing effect, others might experience temporary fluctuations as investors adjust to the news. The magnitude of this short-term impact will depend on the overall market sentiment and the degree of uncertainty previously associated with the rumored fragmentation.

For instance, if the rumors were particularly strong, the initial response might be a significant price adjustment before stabilizing.

Long-Term Effects on Market Volatility

The long-term effect on market volatility is anticipated to be a decrease. By eliminating the possibility of fragmentation, the SEC statement reduces a key source of uncertainty in the market. This predictability is crucial for long-term investors and institutions, enabling them to make more informed decisions. Historically, regulatory uncertainty has been a significant driver of market volatility, and this statement addresses that directly.

Shifts in Investment Strategies

The statement is likely to influence investment strategies, particularly for those focused on the financial sector. Investors might shift their focus to companies that operate within established SEC regulations and are well-positioned for long-term stability. Those that are highly reliant on the SEC, such as securities brokers and investment firms, might experience a significant positive impact. A reduced emphasis on speculation surrounding regulatory changes will allow for more strategic investment.

Sector-Specific Responses

The response will vary by sector.

- Financial Services: This sector is likely to experience the most pronounced positive reaction, with investors shifting towards established players and potentially seeing increased demand for their services.

- Technology: The impact on the technology sector will be less direct, but still noticeable. The elimination of uncertainty in the broader market might encourage more long-term investment in tech companies, provided other factors remain positive.

- Real Estate: Changes in market volatility and investor sentiment may impact real estate valuations, potentially leading to either a period of stability or short-term fluctuations depending on investor confidence and other market conditions.

Illustrative Scenarios

The SEC Commissioner’s statement, downplaying rumors of further market fragmentation, offers a crucial lens through which to examine potential market trajectories. This statement, while seemingly straightforward, has significant implications for investor confidence, future growth, and the very structure of the financial marketplace. Understanding how different stakeholders might react is key to anticipating the overall impact.The statement’s impact on the market hinges on how investors interpret its message.

Positive or negative reactions can snowball into substantial market movements, highlighting the importance of analyzing the possible scenarios. The following sections illustrate these potential outcomes.

Potential for Market Growth and Development

The SEC’s assertion that the current market structure is adequate and that no further fragmentation is planned suggests a belief in the current system’s resilience and effectiveness. This stance could instill confidence in investors, leading to increased participation and capital inflows. A stable and predictable regulatory environment encourages investment, boosting overall market activity. Historical examples of stable regulatory frameworks correlate with periods of robust market expansion.

The market may experience greater investor participation if the statement signals a commitment to a stable regulatory environment.

Scenario: Positive Influence on Investor Confidence

If investors perceive the statement as a reassurance against unnecessary regulatory upheaval, confidence could soar. This would manifest in higher trading volumes, increased investment in securities, and a general uptick in market activity. For example, the 2012 Dodd-Frank Act, while initially causing some market uncertainty, eventually led to a more stable and transparent regulatory framework, eventually boosting investor confidence and leading to increased investment.

This could translate into a more attractive environment for businesses seeking capital, potentially fostering innovation and job creation. The statement, interpreted positively, could lead to sustained market growth and expansion.

Scenario: Negative Impact on Investor Confidence

Conversely, a negative interpretation could lead to market uncertainty. If investors feel the statement dismisses legitimate concerns about market fragmentation or fails to address critical issues, it might spark a decline in investor sentiment. This could manifest in reduced trading volumes, decreased investment, and potentially a downward trend in market capitalization. A perceived lack of proactive measures to address potential issues could lead to investor apprehension, leading to reduced trading activity and potential declines in market valuations.

This negative interpretation could trigger a period of consolidation or even contraction within the market.

Potential for Market Consolidation or Expansion

The SEC’s stance on maintaining the existing market structure, while seemingly stable, could either promote market expansion or consolidation. If the market is already well-structured and the statement reflects this, it could lead to further expansion as new players are attracted to the established, regulated environment. However, if the statement fails to address underlying structural issues or if investors perceive a lack of responsiveness to evolving market needs, it could trigger consolidation as some players might be pushed out or forced to merge to survive.

The SEC commissioner’s comments about FSU not expanding the pie further are interesting, but the overall sentiment surrounding the situation is best gauged by the daily news sentiment index. This index provides a quick look at the collective feeling of news outlets and fans on the matter. Ultimately, the commissioner’s stance on not further dividing the pie seems to hold steady, despite the initial rumors.

The statement, in this case, could trigger a period of market shake-up. This is often observed in mature markets where consolidation occurs to improve efficiency and competitiveness.

Visual Representation of Data

Market share adjustments, especially in the context of large organizations like the SEC, can have ripple effects across the financial landscape. Understanding these adjustments and their potential impacts requires a clear visual representation of historical trends, anticipated market reactions, and investor sentiment. Visualizations help to identify patterns and predict potential outcomes.

Historical Trends of Market Share Adjustments

A line graph depicting the historical market share of different companies or segments over time would effectively illustrate the trends. The x-axis would represent time, perhaps quarterly or annually, and the y-axis would represent the percentage market share. Distinct lines would represent different entities. Adding error bars or shaded regions to indicate confidence intervals would further enhance the visualization.

Color-coding could highlight significant events like regulatory changes or mergers. This allows for a quick and easy understanding of historical fluctuations and the relative stability or volatility of market share.

Potential Impact on Market Capitalization

A bar chart comparing the pre-announcement market capitalization with the potential post-announcement market capitalization for key companies would be informative. This chart can clearly show the magnitude of the possible change. Color-coding (e.g., green for increase, red for decrease) would immediately highlight the potential impact. Consider using different chart types, such as a clustered column chart, to illustrate the changes in market capitalization for different companies or sectors.

The data should be presented in both absolute and percentage change formats to allow for comparison.

Investor Sentiment Shifts

A gauge chart showing a moving average of investor sentiment (e.g., calculated from social media data or news sentiment analysis) would offer insight into potential shifts. The chart would display a gauge that changes based on the sentiment. A consistent upward trend would indicate a positive sentiment shift, while a downward trend would signal negative sentiment. The chart should be updated regularly to reflect the current sentiment.

The chart would need to be calibrated, perhaps with historical sentiment data or using established sentiment analysis models.

Potential Changes in Market Trading Volume

A combination chart showing both market trading volume and the historical average trading volume over time would be highly informative. The chart would overlay the average volume with the actual trading volume. A sudden increase or decrease in trading volume relative to the average would be readily apparent. The x-axis should represent time, while the y-axis would display the volume.

Color-coding would visually differentiate between the average and the actual volume. This visualization would help in understanding whether the statement generated significant market interest or not.

Comparison with Similar Events: Sec Commissioner Downplays Fsu Rumors We Wont Slice Our Pie Into More Pieces

The SEC Commissioner’s statement regarding potential fragmentation of the market raises important questions about historical precedent. Analyzing past regulatory pronouncements and their impact on market sentiment provides valuable context for understanding the current situation. This comparison will highlight similarities and differences, allowing us to better anticipate the possible market reaction.Past regulatory statements, often concerning proposed rule changes or enforcement actions, have triggered varying market responses.

Sometimes, a statement might lead to immediate volatility, while others have had a more muted effect. The anticipated impact of the SEC’s stance on potential market fragmentation will likely depend on several factors, including the specific details of any proposed rule changes and the overall economic climate.

Historical Examples of Regulatory Statements and Market Reactions

Previous regulatory pronouncements, like proposed changes to margin requirements or the enforcement of anti-fraud regulations, have often caused market fluctuations. For instance, the Dodd-Frank Act, a comprehensive regulatory overhaul, initially caused uncertainty and volatility in financial markets as investors grappled with the implications of the new rules. The initial impact varied across different asset classes, with some sectors experiencing more pronounced effects than others.

- The Dodd-Frank Act (2010): This act significantly altered the regulatory landscape for financial institutions. The initial market reaction was one of uncertainty and some volatility, as investors adjusted to the new rules and regulations. Long-term effects varied depending on the specific institution and industry. Some institutions benefited from increased transparency and stability, while others experienced higher compliance costs.

- The Sarbanes-Oxley Act (2002): This act aimed to improve corporate governance and financial reporting. The immediate market reaction was a period of uncertainty, as companies adjusted to the new standards and investors assessed the impact on corporate earnings and valuations. The long-term effect was generally a more stable and trustworthy financial reporting environment, leading to greater investor confidence.

Differences in the Current Situation, Sec commissioner downplays fsu rumors we wont slice our pie into more pieces

While historical precedents provide context, crucial differences exist between past regulatory statements and the current situation. The nature of the potential market fragmentation, the specific details of any rule changes, and the current economic environment all contribute to the unique challenges in predicting market reaction. Unlike some past cases, the present situation involves a less clear, more nuanced debate about the impact of fragmentation.

Therefore, predicting the exact market response requires careful consideration of these distinct aspects.

Impact on Specific Sectors

The SEC’s stance on potential market fragmentation could differentially affect various sectors. For example, the impact on ETFs (exchange-traded funds) might differ from the impact on individual stocks, depending on the specific regulations. Likewise, the impact on high-frequency trading and other market participants could be varied, contingent on the details of any regulatory measures.

Handling Similar Situations in the Past

Past regulatory pronouncements, often involving rule changes or enforcement actions, have been handled by the SEC through various communication strategies. These strategies have ranged from detailed press releases outlining the rationale behind the proposed rules to more informal statements addressing specific concerns. The SEC’s approach to communicating with the market during periods of uncertainty often involves a mix of direct and indirect channels.

This can involve statements made through public forums, as well as discussions with industry representatives.

Last Point

In conclusion, the SEC commissioner’s stance on not further dividing the market pie has significant implications. This article has explored the potential positive and negative impacts, and the diverse reactions likely from investors and market participants. The potential for market consolidation or expansion, as well as the long-term effects on investor confidence, is a crucial element to consider in light of the commissioner’s statement.